Rachel Mendelson/Insider

- Beta measures how much an investment will move compared to its benchmark.

- A stock with higher beta may offer greater returns, but can also lead to larger losses.

- Beta may be helpful for making short-term decisions, but it doesn't reflect a company's fundamentals.

- Visit Insider's Investing Reference library for more stories.

Investing is, in part, an exercise in managing risk as you seek higher returns. But there are different types of risk you need to account for before investing your money. Some types of risk are systematic – they affect all stocks. And beta is a way to measure a particular investment's susceptibility to these broader market changes.

What is beta?

Beta – the Greek letter β – measures how an investment changes relative to a broader index. It can be helpful in determining whether a stock, fund, or entire portfolio could experience large swings in the future.

"In its simplest form, beta is a measure of volatility or risk," explains Tanner Bortnem, a senior financial advisor at Harmoney Wealth. "The starting point is the overall market, and typically the S&P 500 is used as a benchmark – this benchmark is given a beta value of 1." An asset's beta measures how much its price will change when the benchmark's price changes.

If a small tech company has a beta of 2, its stock price will increase or decrease twice as much as the benchmark's price. But a large company with a beta of 0.5 will increase or decrease half as much as the benchmark. Investments that have a negative beta move in the opposite direction of the benchmark.

Understanding how beta works

Beta works by estimating the correlation between an asset's movement and changes in the market overall based on historical data. In doing so, it measures systematic risk – meaning risk that can't be avoided through diversification because it's not specific to a particular investment.

For example, a company that's doing well might still experience a drop in its stock price if the entire market is falling during a recession. But how much the price drops could depend on its beta.

Beta isn't the only type of risk investors need to consider, and it's one of five risk assessment ratios in modern portfolio theory:

- Alpha measures an investment's returns relative to a benchmark.

- Beta measures an investment's volatility relative to a benchmark.

- R-squared measures how much an investment moves in correspondence with a benchmark.

- Standard deviation measures volatility based on an investment's returns.

- Sharpe ratio measures the risk-adjusted return of an investment.

Financial advisors, active investors, and fund managers may use these to analyze an entire portfolio, or how a new investment could impact a portfolio.

How do you calculate beta?

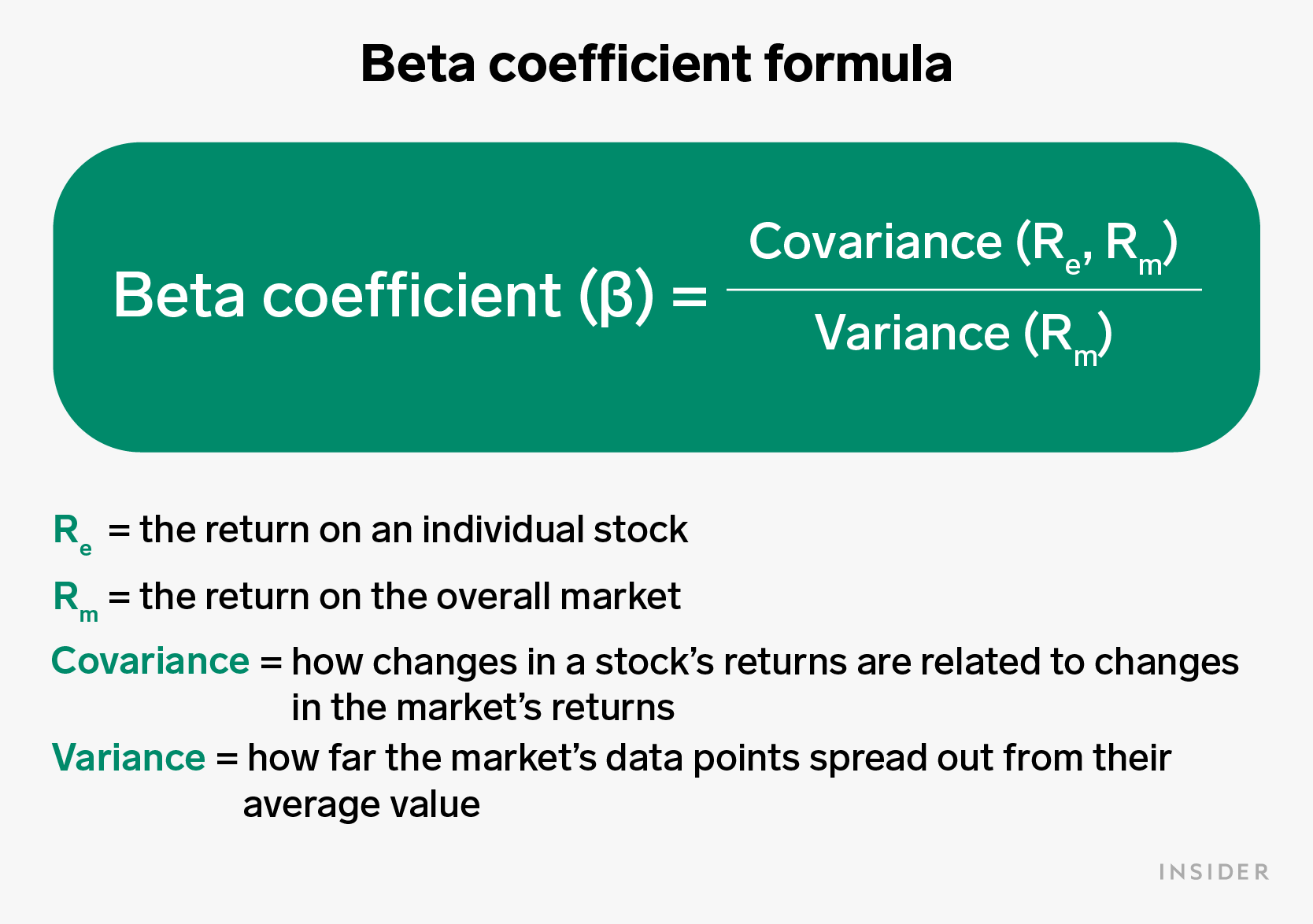

There are several ways to measure beta, but the covariance/variance method is a commonly used approach. The formula is:

Fortunately, you don't have to calculate the beta of a stock on your own. You may be able to find a stock or fund's beta financial data sites. However, you may want to see what the site uses as a benchmark and the period it uses when calculating the stock's beta.

Using beta when making investment decisions

Beta can be particularly important for investors who might not want to have their portfolio make big swings. And for investors who may need the money in the short-run and wouldn't have time to recover if there's a quick downturn.

"The most important part for retail investors to know about beta is that you will want to ensure you have diversification," says Bortnem. "A well-constructed portfolio has diversification of investments. The same should be done for beta."

While the beta coefficient measures a non-diversifiable risk, you can protect against large swings in your overall portfolio by choosing investments that have negative, low, moderate, and high betas.

"This will give you a well-diversified portfolio in terms of both the investments themselves, but also investments that will perform well in the different economic cycles," says Bortnem.

Keep in mind that a stock could have a volatile price and still have a low beta if the volatility isn't correlated with changes in the market. Also, because beta is based on historical returns, an asset's beta may change over time.

Beta vs. alpha

While beta measures how an investment may change with the market, alpha measures how well an investment performs relative to the market. They can be used together when researching investment opportunities.

Beta is actually a vital component of the capital asset pricing model (CAPM). The CAPM formula can be used to estimate the expected return of an asset based, in part, on its beta. This can then be compared to the asset's actual return to see if it generated alpha - or beat its benchmark without taking on additional risk.

It could be important to consider alpha and beta in tandem when you're reviewing investment opportunities. Bortnem shares a simple example of why:

- An investor had an annual return of 18% with a beta of two, meaning the portfolio was 100% more volatile than the market.

- If the benchmark return was 6%, then the investor has a positive alpha. They took on twice the risk (beta of two) and made three times the return - 18% compared to the benchmark's 6% benchmark. They were paid well for the risk they took.

- However, if the benchmark return was 12%, then the investor took on twice as much risk but only gained 50% of the return.

If you only look at the investment's 18% return, you miss whether it's done well relative to the amount of risk you're taking on. "It all starts with understanding beta, and once you know that, you can calculate your own portfolio's alpha to see if the performance you are getting is worth the risk you are taking," says Bortnem.

The financial takeaway

Predicting how much an investment - or your entire portfolio - may move when the market is up or down can be an important component of investing.

If you don't want to experience big swings, you could look for options that have a low beta. Or, hedge against high beta investments with investments that have a negative beta. If you're not as risk averse, you could look for options with a higher beta that could lead to larger returns. But be careful, a high beta can also mean bigger losses.

Also, remember that beta doesn't measure factors that may be specific to a single company or asset. It can be helpful in building your portfolio, but you want to consider beta within a larger context and only as one once piece of analysis.